Support the financial (and mental) wellbeing of your staff

Recent economic developments are exacerbating personal financial concerns among the UK population, impacting the wellbeing of workers and their families. Employers wishing to support their workforce during this potentially stressful time would do well to focus on financial help, to balance out their mental wellbeing offers.

CIPD research1 with employers with health and wellbeing strategies found that only 11% actively focus on financial wellbeing, compared with 57% that actively focus on mental wellbeing. However, there’s a strong link between the two: financial worries are a great contributor to poor mental health, with people who are falling behind on paying the bills, those borrowing more money, and those using more credit than usual significantly more likely to experience high levels of anxiety and low levels of life satisfaction and happiness2.

With a fifth of UK adults borrowing more money or using more credit now than in early 2022, and 42% unlikely to be able to save money this year2, companies can expect to see a decline in productivity and engagement from their employees, as they struggle to cope with personal finances.

What can your company do?

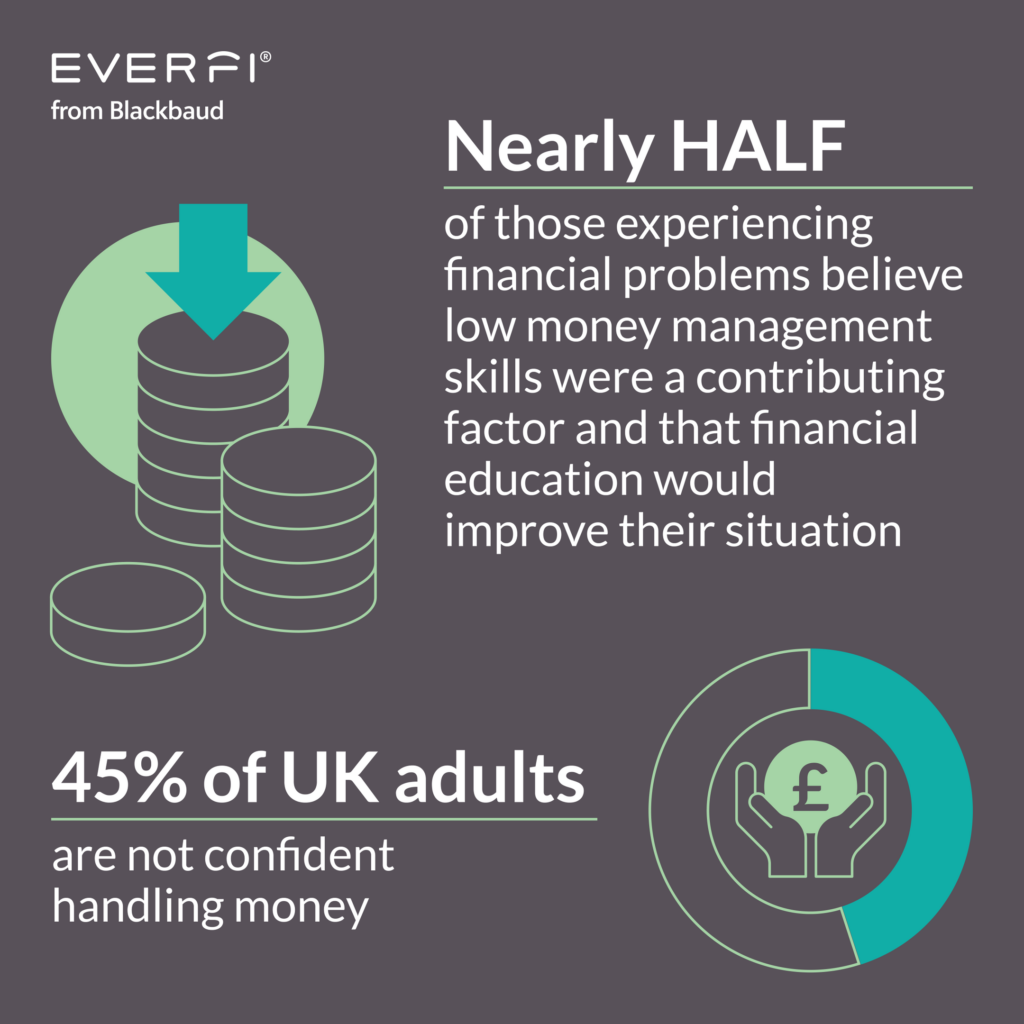

There’s more that employers can do beyond paying adequate compensation. Financial education is often underestimated; it can make a big difference when people are dealing with a difficult economic climate and tightened personal finances. With only 48% of us receiving basic financial education at home or during our time in school, there’s a knowledge gap in the adult population regarding topics like budgeting, taxes, credit, savings, and investments. The Centre for Social Justice (CSJ)3 has found that:

Employer-sponsored financial wellbeing policies are among the recommendations from the CSJ to address low levels of financial literacy.

Support your staff with financial literacy

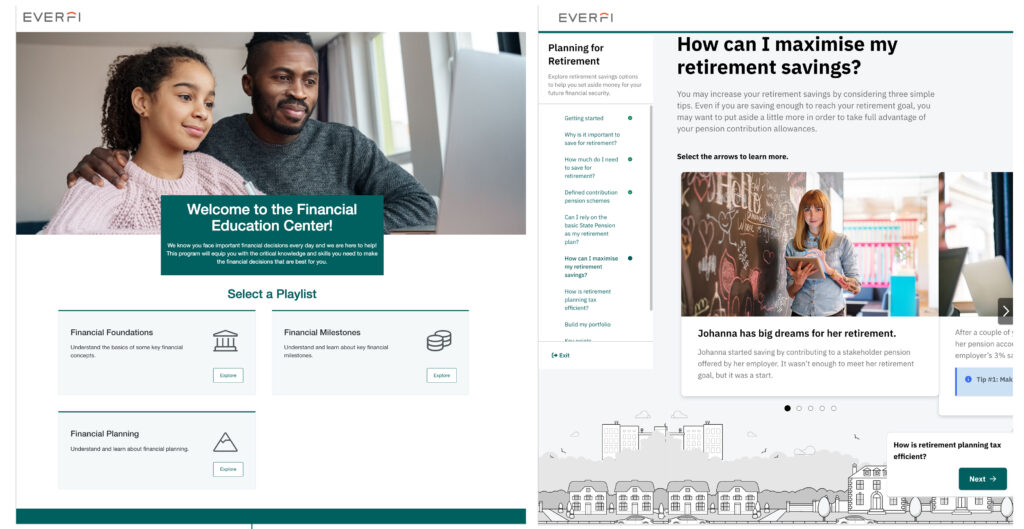

EVERFI enables companies like yours to deliver white-labelled financial education to your employees, customers and their families, so they can build financial literacy and confidence wherever they are.

Our online course Achieve is a scalable financial wellness offer that lets learners choose the topics they’re interested in and go through short modules at their own pace. It provides important knowledge such as:

- Financial foundations, covering savings, budgeting, bonds, and bank accounts

- Finance throughout life, covering healthy money habits, identity protection, and family conversations about money

- Life planning, covering insurance, retirement, sustainable investing, and general wellbeing

Achieve offers financial education in short modules covering key topics

Achieve also enables your company to report on the impact of the course, delivering comprehensive data reporting on learner activity. Learn more on the course page.

Ready to act?

Support your employees’ wellbeing with financial education

Stay Informed

Best practices, the latest research, and insights from our expert network of partners, delivered right to your inbox.

Success!Thank you for signing up. We'll be in touch with more relevant content.